Propaganda Isn't Just About Printing Fake News, It's Also Hiding Real News!

- Julie O'Connor

- Dec 15, 2022

- 7 min read

First let me clarify that I'm not blaming the journalist for the propaganda article below, because the decision to cover-up a cover-up with any political connection would have been made by someone way above his pay grade. I have no doubt that a cover-up took place because three parties were offered a financial incentive which would cover-up allegations of a pattern of fraud which implicated a client of a politically connected law firm and Government linked bank. This was despite the Singapore Prime Minister's repeated public claims that cover-ups are not allowed, and no-one is above the law.

It's common knowledge that many Singaporeans believe the local press is a mouthpiece of the ruling party, funded to publish propaganda and protect those connected to the power structure. So, when we see blatant examples, I believe we should expose them. It was a few weeks ago that numerous Singaporeans sent me the article below in total disgust and who can blame them if they were one of those investors who saw the crew of EZRA and the Tri-tanic jump to safety, leaving them without a seat on the lifeboat. I suspect they reached out to me because I have been following the company which is the subject of the article since 2012.

At first glance the article appears to be nothing more than a propaganda puff piece. A 'test balloon' to prepare investors to throw in funds to support the launching of yet another SGX vessel, which is being steered by the same captain who saw his last vessel hit a proverbial iceberg!

The first bit of misinformation to jump out at me was the claim that Strategic Marine had built and delivered more than 600 vessels since 2020. I'm no expert, but even I could tell that number was greatly exaggerated and was a physical impossibility for the Strategic Marine Singapore yard to achieve.

Even if the above could be written off as a genuine error, what was blatant propaganda was how the article described the Strategic Marine CEO Eng Yew Chan ["Chan"] as a 'former banker'. A quick Google search will confirm that Chan was a relationship manager of UOB way back in 1998 - 2003, but we are now at the end of 2022! It was Chan's more recent career that had direct links to the subject matter of the article, but which I believe was deliberately omitted. They say that transparency is nothing to fear if there's nothing to hide, but there was much to hide and many to protect by keeping Chan's background out of the article.

The Singapore shipbuilder eyeing an IPO listing is Strategic Marine, which is a former subsidiary of the now defunct SGX listed Triyards Holdings. Up until February 2020 Chan wasn't a banker, he was the CEO of Triyards Holdings, prior to which he had been the CFO of the now under Judicial Management EMAS Offshore and interim-CFO of the now collapsed EZRA Holdings. All three entities belonging to the same group.

It was following pressure exerted over Triyards by Government Linked DBS bank, that an entity hiding behind a BVI acquired at least two of the Triyards' Strategic Marine assets prior to Judicial Managers from PwC being appointed. Chan would leave Triyards the day that Judicial Managers were appointed and become CEO of this 'new' Strategic Marine entity, taking along many members of the team with him.

In October 2020, Chan as Strategic Marine's CEO stated that "The last 18 months have been an exciting journey as we have reconnected with many of our old customers who have welcomed us back. Had anyone checked, they would have discovered that for 10-months out of that 18-month period that Chan was referring to, he had been the Triyards CEO and Strategic Marine had already been hived off to the new mystery owner. I'm confident that Triyards or EZRA Holdings' investors wouldn't have described watching their investment disappear as exciting and neither should the CEO. Understandably, to now have Singapore's propaganda press promoting this new entity would leave a rather bitter taste in the mouth of the many who stand to lose their investments, whilst no-one was held accountable.

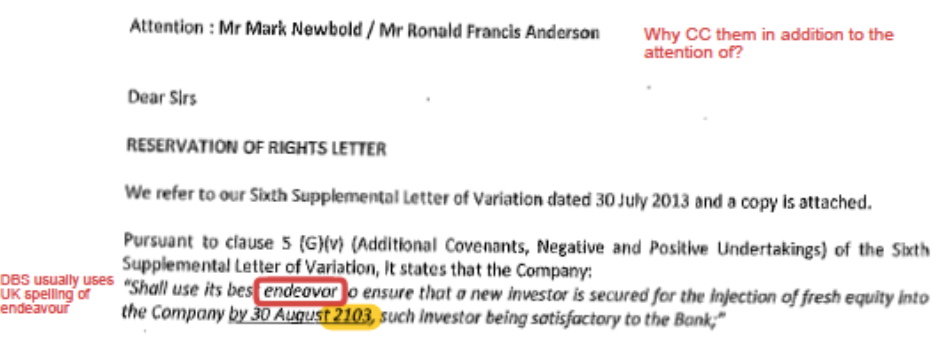

Chan was also not a banker when Triyards originally acquired Strategic Marine from its Australian owner Strategic Marine Pty Ltd. Chan was a Triyards board member and CEO. This 'questionable' acquisition was accomplished after alleged pressure was exerted once again by DBS. Many concerns were formally submitted to the Triyards Audit Committee following that acquisition and prior to Chan, the Chairman and COO quietly stepping down from the Triyards Board en masse. The concerns raised included but were certainly not limited to the use of the CEO of KTL Global Tan Kheng Yeow in a conspiracy to defraud, and the Triyards Chairman being implicated in affixing forged signatures to Strategic Marine documents on behalf of a struck off entity.

If research had been conducted for the Straits Times article it would have uncovered that the 'new' Singapore Strategic Marine owner is hidden behind a BVI entity, much like how the EZRA Holdings MD/Triyards Chairman previously hid behind a beneficial claim in a Bahamas entity. As the author of this article noted, previous companies involving the Lee family have gone bust, "But like a phoenix, Mr Lee managed to list EZRA in 2003 in Singapore on the basis of a few anchor handlers and a crewboat..." Investors can't be criticized for their concerns that this 'new' Strategic Marine might turn out to be just another phoenix, which has bought up the assets of Triyards and left investors with nothing but bitter memories.

Following the collapse of not just Triyards but it's major shareholder EZRA Holdings, in addition to many Singaporeans facing losses, Chiyoda and NYK were forced to write down US$336 million and US$114 million respectively, DBS faced a financial exposure of at least US$452 million, OCBC US$213 million and UOB $117 million. Who knows what the total accumulated losses will be. In addition to the A$3.5 million offered which would hide allegations of fraud from investors prior to over US$2 billion of proposed transactions being announced, there were repeated non-disclosures, allegations of forgery, an undisclosed related party transaction, arguably failure to disclose material information on a timely basis, false or misleading disclosures, failure to disclose interests in transactions, possible attempt at insider trading, and failure to discharge directors’ duties prior to the group collapsing. But there would be no investigation, only an assessment undertaken by the Commercial Affairs Department of the Singapore Police Force ["CAD"]. Chan himself confirmed that no-one from CAD questioned any Board Member, Executive or member of management of Triyards before CAD claimed case closed due to lack of evidence. Ironically, including the evidence which A$3.5 million had been offered to hide!

It appears to me, that in addition to banking secrecy, legal privilege and impotent regulators which have enabled a cover-up, Singapore's press is now playing their part with propaganda articles such as that above, and it stinks as much as the Noble collapse did. Michael Dee, a former MD of Temasek wrote in relation to Noble "The PWC review was a complete sham with massive disclaimers and a very narrow mandate conducted by a firm which had a conflict with a director who had a nine-year relationship with PWC. Noble used that report to claim their accounting was vindicated, yet PWC’s own words in the report prove that claim was not even remotely true."

In the case of the EZRA Group, PwC wasn't only the Judicial Manager for members of the Group, but it is also the auditor for DBS which face the largest losses following the groups collapse. I raised red flags with DBS Group Heads of Financial Crime, Group Company Secretaries and later two PwC Partners in Charge of the DBS audit all of whom would later leave their roles. I have no idea if PwC raised my serious concerns with the DBS Board, but I certainly did. I would say that PwC were once again in a position of conflict, and I wasn't surprised when no red flags were raised during their judicial management which would open the can of worms.

Michael Dee went on to say about Noble that "The SGX and MAS have proven themselves incapable and impotent while greed has blinded the vast array of financial intermediaries who have enabled this tragedy." This begs the question whether the covering up of errant and arguably corrupt activities in the EZRA Holdings Group is not isolated and can be attributed to other corporate collapses in Singapore? Will we see any accountability or just more heads in the sand, more NDAs, and more propaganda press which will further diminish trust in Singapore's financial institutions, regulators, auditors, legal bodies and ruling party?

Using some of the words from Michael Dee's final paragraph in his letter to Noble's shareholders, creditors, bondholders, and employees, 'It's time to pull open the curtain, blow away all the smoke and once and for all determine whether the *EZRA Holdings Group has been noble in all its actions or whether it has been fraudulent in its activities to the benefit of a corrupt management and board. If the former I will gladly acknowledge this, but if not, the harshest criminal and financial penalties should be applied to everyone involved, including those who deliberately covered up what took place.

I'm confident that the truth will be exposed whether today, tomorrow, next month, next year or in another ten-years, because what took place will be gnawing away at those individuals who do have integrity, but who just need to find the courage to speak out. There are many who know what took place and the cover-up which followed. As we saw with the City Harvest Church, National Kidney Foundation and Noble scandals, a rotten situation allowed to fester doesn't smell better over time and this one stinks.

Someone on LinkedIn shared the snippet below with me and I thought it was very apt.

"This is reminiscent of early WW2 when the Germans were bombing the UK using radio beams for guidance. The Brits suspected the existence of the beams and interrogated a captured German bomber crew about them. The crew denied any knowledge and were led back to their room. The room was bugged and the Brits heard the Germans laughing and saying, “You know, they will never find it.” The Brits found the equipment on a shot-down German bomber and used the knowledge to defeat the Knickelbein system, the first of three German beam systems defeated during the war. '

Last but certainly not least, if Singapore's press had even a whiff of independence, they would be following up on the plight of Singapore whistleblower Jeanne Ten.

Comments